Crafting Your Investment Mix for Maximum Growth

When it comes to building a balanced investment portfolio for optimal returns, one of the key factors to consider is crafting the right investment mix for maximum growth. This involves carefully selecting a combination of different types of investments that work together to help you achieve your financial goals.

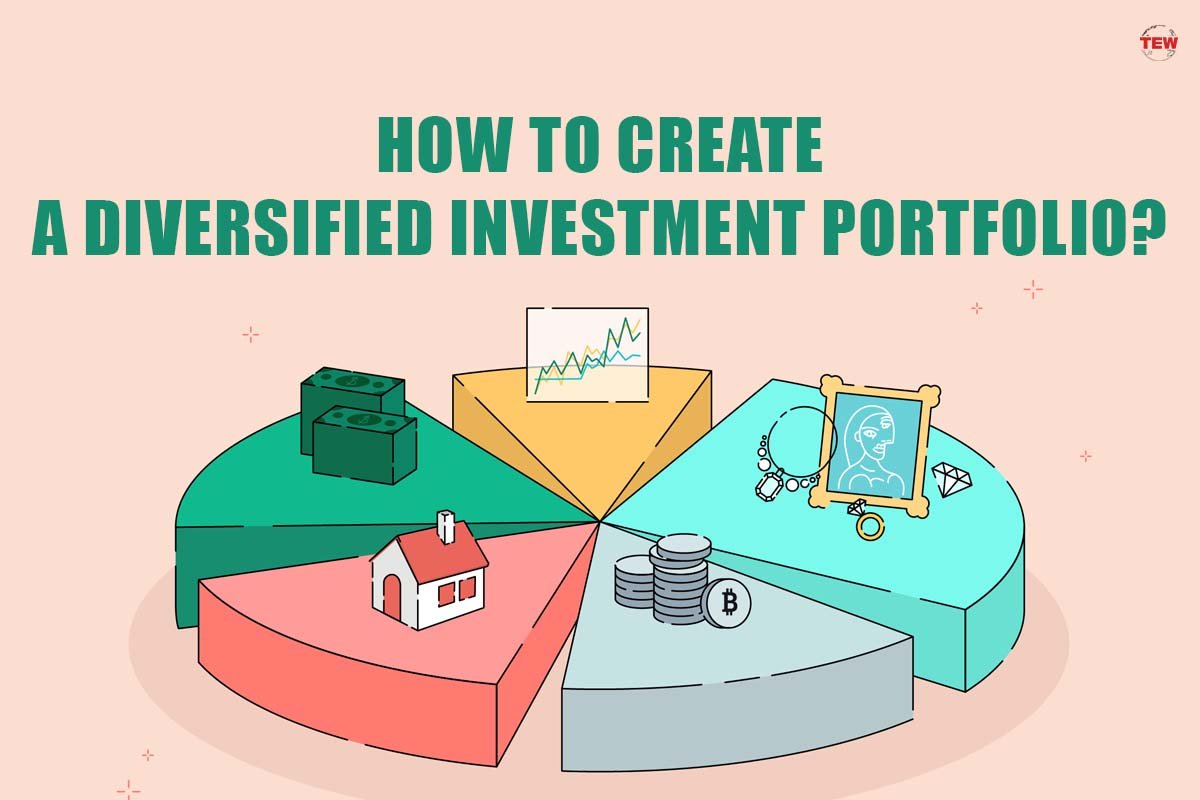

To start, it’s important to understand the different types of investments available to you. These can include stocks, bonds, real estate, mutual funds, and more. Each type of investment carries its own level of risk and potential for returns, so it’s crucial to diversify your portfolio to mitigate risk and maximize growth.

When crafting your investment mix, consider your risk tolerance, time horizon, and financial goals. Are you investing for long-term growth, or are you looking for more immediate returns? Understanding your individual investment objectives will help you tailor your portfolio to meet your specific needs.

One strategy for achieving maximum growth is to allocate a larger portion of your portfolio to higher-risk, higher-reward investments, such as stocks. While stocks can be volatile in the short term, historically they have provided strong returns over the long term. By including a mix of growth stocks, value stocks, and dividend-paying stocks in your portfolio, you can tap into the potential for capital appreciation and income generation.

Image Source: theenterpriseworld.com

In addition to stocks, consider incorporating bonds into your investment mix. Bonds are typically less risky than stocks and provide a steady stream of income through interest payments. By including a mix of government bonds, corporate bonds, and municipal bonds in your portfolio, you can diversify your risk and potentially enhance your overall returns.

Real estate is another asset class to consider when crafting your investment mix for maximum growth. Real estate investments can provide both income and capital appreciation potential, making them a valuable addition to a well-balanced portfolio. Whether you choose to invest in rental properties, real estate investment trusts (REITs), or real estate crowdfunding platforms, real estate can help diversify your portfolio and enhance your overall returns.

Mutual funds are another popular investment option for those looking to achieve maximum growth. By investing in a mix of stocks, bonds, and other securities through a mutual fund, you can benefit from professional management and instant diversification. Mutual funds offer a convenient way to access a diversified portfolio of investments without the need for significant time or expertise.

As you craft your investment mix for maximum growth, don’t forget to regularly review and rebalance your portfolio. Market conditions and your individual financial situation may change over time, so it’s important to adjust your investments accordingly. By periodically reassessing your asset allocation and making necessary adjustments, you can ensure that your portfolio remains aligned with your investment goals and risk tolerance.

In conclusion, crafting the right investment mix for maximum growth is a key component of building a balanced investment portfolio for optimal returns. By diversifying your investments across different asset classes and carefully selecting a mix of stocks, bonds, real estate, and mutual funds, you can position yourself for long-term financial success. Remember to consider your risk tolerance, time horizon, and financial goals when crafting your investment mix, and be sure to regularly review and rebalance your portfolio to stay on track towards achieving your investment objectives.

Achieving Financial Success with a Well-Balanced Portfolio

When it comes to building a successful investment portfolio, balance is key. A well-balanced portfolio is one that is carefully constructed to include a mix of different types of investments, each with its own level of risk and potential for return. By diversifying your investments in this way, you can help to protect yourself against market fluctuations and maximize your overall returns.

One of the first steps in building a well-balanced portfolio is to determine your investment goals and risk tolerance. Are you looking for long-term growth, or are you more interested in preserving your capital? How much risk are you willing to take on in pursuit of higher returns? By answering these questions, you can begin to tailor your investment mix to meet your specific needs and objectives.

Once you have a clear understanding of your goals and risk tolerance, it’s time to start building your portfolio. A well-balanced portfolio typically includes a mix of stocks, bonds, and cash equivalents. Stocks offer the potential for high returns but also come with a higher level of risk, while bonds are generally considered to be safer but offer lower returns. Cash equivalents, such as money market funds, provide stability and liquidity.

In addition to these traditional asset classes, many investors also choose to include alternative investments in their portfolios, such as real estate, commodities, or hedge funds. These types of investments can help to further diversify your portfolio and reduce risk.

Another important consideration when building a well-balanced portfolio is asset allocation. This refers to the percentage of your portfolio that is invested in each asset class. A common rule of thumb is to divide your portfolio evenly between stocks and bonds, with the remaining portion allocated to cash equivalents and alternative investments. However, the optimal asset allocation for you will depend on your individual circumstances and investment goals.

Rebalancing your portfolio on a regular basis is also crucial to maintaining its balance over time. As the value of your investments fluctuates, your asset allocation can drift away from your target levels. By periodically adjusting your holdings to bring them back in line with your desired allocation, you can help to ensure that your portfolio remains well-balanced and aligned with your investment objectives.

In conclusion, building a well-balanced investment portfolio is essential for achieving financial success. By diversifying your investments across different asset classes, carefully considering your goals and risk tolerance, and regularly rebalancing your portfolio, you can help to maximize your returns while minimizing your overall risk. So, take the time to craft a well-balanced portfolio that is tailored to your individual needs and watch as your investments work together to help you reach your financial goals.

How to Create a Diversified Investment Portfolio for Maximum Returns