Guarding Your Wealth: Tips for Beating Inflation

In today’s fast-paced world, it’s more important than ever to protect your hard-earned money from the effects of inflation. Inflation is the gradual increase in prices of goods and services over time, which erodes the purchasing power of your money. If left unchecked, inflation can eat away at your savings and investments, making it crucial to find ways to beat it.

So, how can you guard your wealth and beat inflation? Here are some tips to help you navigate the impact of inflation and protect your investments:

1. Invest in Real Assets:

One of the best ways to beat inflation is by investing in real assets such as real estate, precious metals, and commodities. These assets tend to retain their value over time and can provide a hedge against inflation. Real estate, in particular, is a great investment option as property values tend to increase over the long term, keeping pace with or even outpacing inflation.

2. Diversify Your Portfolio:

Diversification is key to protecting your investments from the impact of inflation. By spreading your money across different asset classes such as stocks, bonds, and real estate, you can reduce the risk of losses due to inflation in any one particular investment. A well-diversified portfolio can help you weather economic downturns and preserve your wealth over the long term.

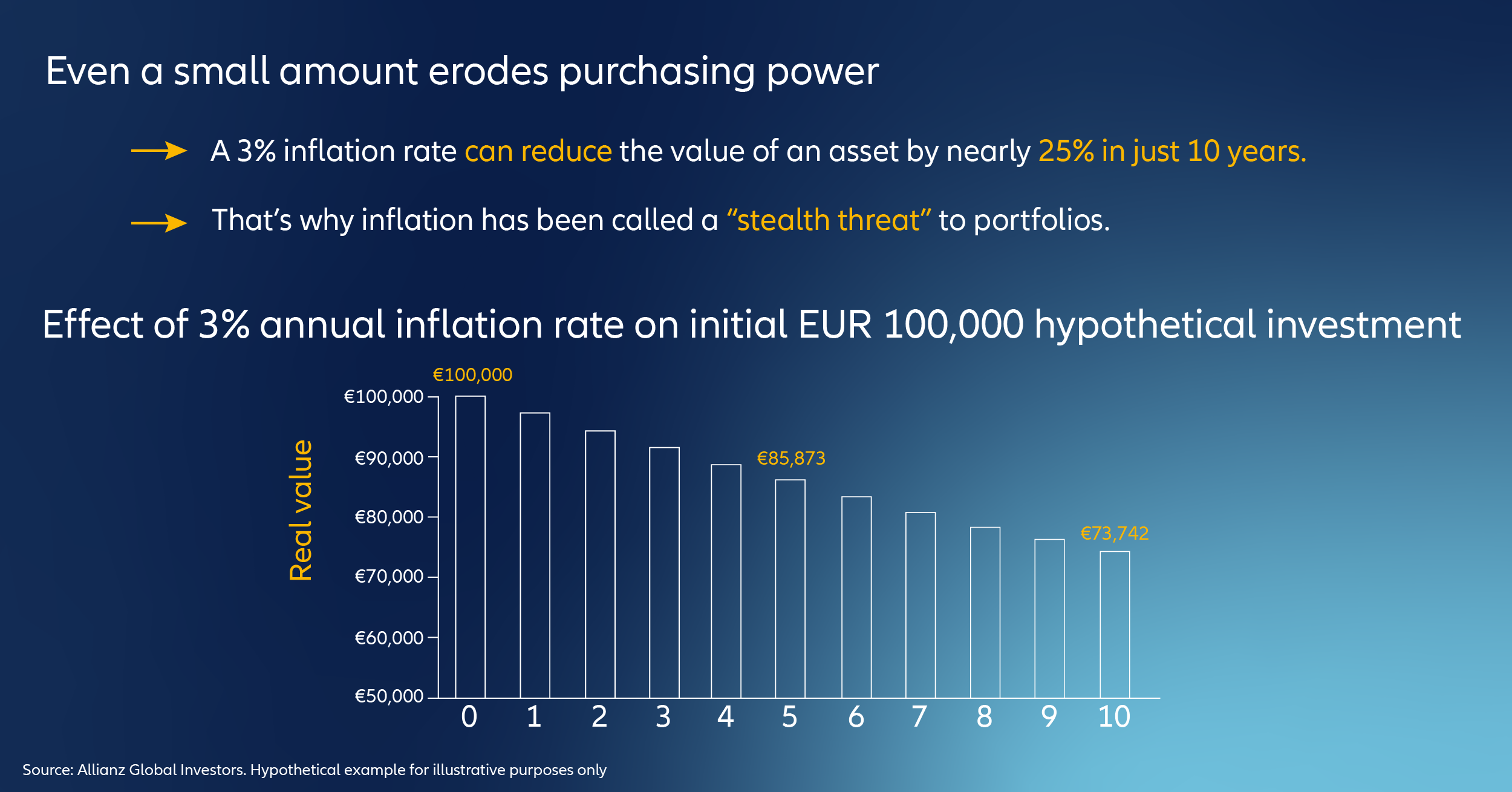

Image Source: allianz.com

3. Invest in Inflation-Protected Securities:

Treasury Inflation-Protected Securities (TIPS) are government bonds that are specifically designed to protect investors from inflation. The principal value of TIPS increases with inflation, ensuring that your investment keeps pace with rising prices. By investing in TIPS, you can safeguard your wealth and maintain the purchasing power of your money in the face of inflation.

4. Consider Dividend-Paying Stocks:

Dividend-paying stocks are another great investment option for beating inflation. Companies that consistently pay dividends tend to have stable cash flows and strong balance sheets, making them less susceptible to the effects of inflation. By investing in dividend-paying stocks, you can earn a steady income stream that can help offset the impact of rising prices on your investments.

5. Monitor Your Investments Regularly:

Inflation is a constant force that can erode the value of your investments over time. To protect your wealth, it’s important to monitor your investments regularly and make adjustments as needed. Keep an eye on the performance of your portfolio, review your asset allocation, and rebalance your investments to ensure that you are well-positioned to beat inflation and preserve your wealth.

In conclusion, protecting your investments from the impact of inflation is essential for securing your financial future. By following these tips for beating inflation, you can guard your wealth, preserve your purchasing power, and achieve long-term financial success. Remember to stay proactive, diversify your portfolio, and invest in assets that can withstand the effects of inflation. With careful planning and strategic investment decisions, you can navigate the challenges of inflation and safeguard your investments for years to come.

Protecting Your Investments: Navigating the Impact of Inflation

Rise Above the Rest: Strategies to Preserve Your Investments

As an investor, one of the biggest challenges you may face is navigating the impact of inflation on your investments. Inflation erodes the purchasing power of your money over time, making it essential to find strategies to preserve the value of your investments. With the right approach, you can rise above the rest and protect your wealth from the effects of inflation.

One of the most effective strategies to preserve your investments in the face of inflation is diversification. By spreading your investments across a range of asset classes, you can reduce the risk of any single asset underperforming. Diversification can help you weather market fluctuations and inflationary pressures, ensuring that your portfolio remains resilient over the long term.

Another key strategy to preserve your investments is to focus on high-quality assets. Investing in assets with strong fundamentals and a history of stable returns can help shield your wealth from the erosive effects of inflation. High-quality assets are more likely to retain their value during times of economic uncertainty, making them a reliable hedge against inflation.

In addition, consider investing in assets that have a track record of outperforming inflation. Assets such as real estate, commodities, and inflation-protected securities can provide a reliable source of returns that outpace the rate of inflation. By including these assets in your portfolio, you can ensure that your investments continue to grow in real terms, even in the face of rising prices.

It’s also important to stay informed about economic trends and market developments that could impact the value of your investments. Keeping abreast of inflation rates, interest rate movements, and other macroeconomic factors can help you make informed decisions about your investment strategy. By staying proactive and adaptable, you can adjust your portfolio to mitigate the effects of inflation and capitalize on emerging opportunities.

Furthermore, consider working with a financial advisor to develop a personalized investment plan that aligns with your financial goals and risk tolerance. A skilled advisor can help you navigate the complexities of the investment landscape and make informed decisions about your portfolio. With their guidance, you can develop a robust investment strategy that protects your wealth and maximizes your returns in the face of inflation.

In conclusion, preserving your investments in the face of inflation requires a proactive and strategic approach. By diversifying your portfolio, focusing on high-quality assets, investing in inflation-beating assets, staying informed about market trends, and working with a financial advisor, you can rise above the rest and protect your wealth from the erosive effects of inflation. With the right strategies in place, you can navigate the impact of inflation and ensure that your investments continue to grow and thrive over the long term.

The Impact of Inflation on Your Investments and How to Protect Yourself